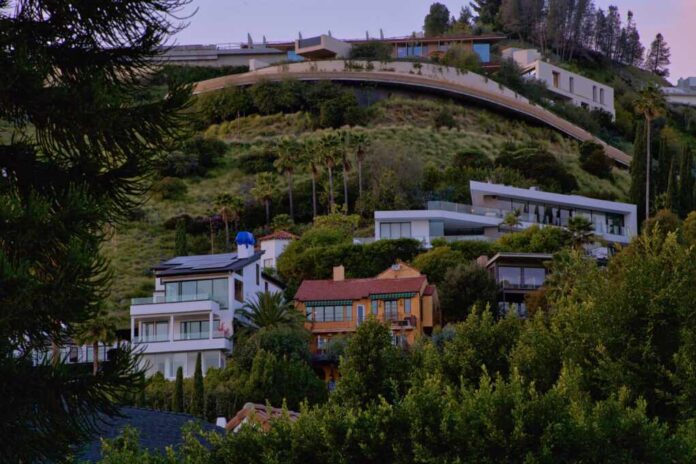

The Ninth Circuit Court of Appeals is set to hear a challenge to Measure ULA, Los Angeles’s high-end property sales tax aimed at funding affordable housing. The measure, approved in November 2022, has fallen short of its revenue targets, leading to legal disputes and public criticism.

Measure ULA imposes a 4% tax on property sales over $5 million and a 5.5% tax on sales over $10 million, with an anticipated $900 million annual revenue. However, it has only generated $252.9 million to date, according to the city controller. A rush of sales before the tax’s implementation and high interest rates have hindered its success.

The Howard Jarvis Taxpayers’ Association (HJTA) has filed a lawsuit claiming Measure ULA violates California’s Proposition 13 by unlawfully expanding the city’s taxation authority. Although a Los Angeles County judge dismissed the suit last year, HJTA is appealing the ruling. A statewide ballot measure set for 2024 could further complicate matters, as it would require a two-thirds majority for any tax increases, potentially putting Measure ULA back to a vote. This measure is currently under review by the state’s supreme court.

Additionally, Newcastle Courtyards has brought a federal civil rights case against Measure ULA, arguing that the tax was misrepresented as targeting only the wealthy while ignoring that some high-end property sellers might be in financial distress. This case was dismissed by a district court for lack of jurisdiction over state taxes, but Newcastle Courtyards is continuing its appeal.

The upcoming decision by the Ninth Circuit will be pivotal in determining the future of Measure ULA and its role in addressing Los Angeles’s affordable housing crisis. The case underscores the ongoing tension between taxation policies and housing affordability efforts in California.