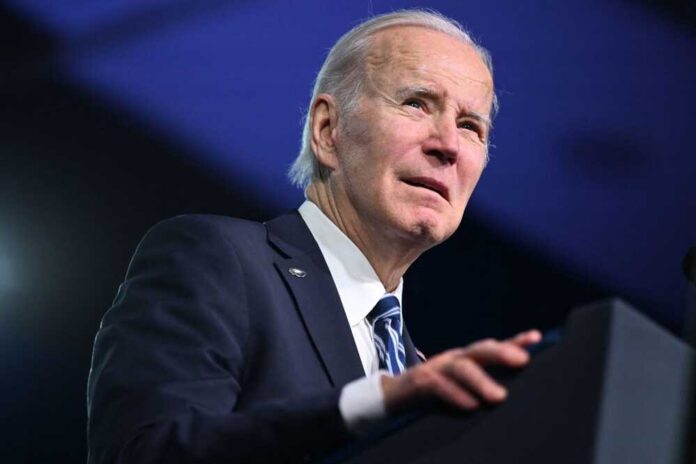

President Joe Biden issued the first veto of his tumultuous administration, and it could not have been more symbolic of how much he is under the thumb of woke leftist radicals.

His veto halted a bipartisan effort to prevent pension fund managers from basing their investment decisions on unrelated and potentially unprofitable factors such as climate change and social justice.

House Speaker Kevin McCarthy (R-CA) blasted the president for siding with far left causes over the financial security of tens of millions of Americans. “President Biden’s first veto is against a bipartisan bill that protects retirement savings from political interference.”

His statement continued with criticism of Biden for siding with “a far left political agenda” over allowing hard earned money that is responsibly saved to grow.

Your retirement savings are your money, not Joe Biden's.

Wall Street should maximize your returns, not fund Biden's Far Left political agenda. https://t.co/3YxDoeDLMz

— House Republicans (@HouseGOP) March 20, 2023

Environmental, social and corporate governance (ESG) investing prioritizes leftist social and political causes over securing the maximum profit for investments of retirement savings.

Critics charge this is hurting vulnerable seniors as well as the economy.

Some Republicans place part of the blame for Silicon Valley Bank’s shocking collapse on it being “one of the most woke banks” in the U.S. That’s the word from House Oversight Committee Chair James Comer (R-KY), who believes the institution collapsed partially due to “woke capitalism.”

The House version of the bill passed with a single Democratic vote in favor, while the Democrat-controlled Senate also passed the measure with a 50-46 tally.

One of the Senate Democrats who joined his Republican colleagues, Joe Manchin of West Virginia, said the president emphasized a “radical policy agenda” over the wishes of U.S. investors.

Calling the veto “infuriating,” Manchin said the Biden White House insists on pushing this agenda “over the economic, energy, and national security needs of our country.”

Biden inexplicably defended his first veto on Twitter, saying that the bipartisan measure approved by Congress “would put at risk the retirement savings of individuals across the country.”

That’s not even a serious statement. ESG investing is the opposite of seeking the most profitable avenue for retirement funds to grow and prosper. Instead, it seeks to steer seniors’ life savings towards leftist causes and woke corporations.

The vetoed measure would have axed a new Labor Department rule promoting private retirement accounts to factor in ESG considerations in their investment strategies.